tax avoidance vs tax evasion uk

Tax evasion means concealing income or information from tax authorities and its illegal. Tax Avoidance And Tax Evasion aCOWtancy Textbook.

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Genuine mistakes on a tax return such as misculautions and missed.

. Basically tax avoidance is legal while tax evasion is not. Its as simple as that. One is illegal the other legal though arguably immoral on a larger scale.

Effective tax planning will mean more money in your pocket either for investing or for spending. However the simple difference between the two is the legality behind the actions. Contact the HMRC fraud hotline if you cannot use the online service.

It is the illegal practice of not paying taxes not reporting income reporting illegitimate expenses or not making payment for taxes owed. Avoiding tax is legal but it is easy for the former to become the latter. UK Tax System Administration A2.

This comes after a push to tackle tax avoi. Furthermore it is an illegal offence. Tax evasion is the deliberate non-payment of taxes that is illegal.

44 203 080 0871. ACCA TX UK Notes. HMRC has confirmed that it has generated billions in additional tax revenue in recent years.

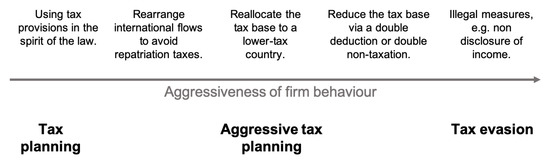

Understanding how tax evasion and tax avoidance compare is key to avoiding landing yourself in hot water or worse committing a criminal offence. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the law.

Businesses get into trouble with the IRS when they intentionally evade taxes. Crossing that line can lead to hefty fines and prosecution. We have gathered examples from recent and historic high-profile cases to help you unpick the fine line between tax avoidance.

HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax evaders do not disclose their taxable assets fake off-shore accounts hide the details of their income and conceal the financial reporting from HMRC. Tax evasion is ILLEGAL. Perhaps we should start with what tax fraud and tax evasion have in common which is that they are both federal crimes.

Estimated that in 201920 the Exchequer loss from tax avoidance was 15 billion while the cost of tax evasion was 55 billion. Other ways to report. To make sure you have all of the details so you can better understand tax avoidance vs tax evasion our expert team of experienced tax solicitors who.

In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B consists of two reports one. Examples of tax evasion. This activity is where information is omitted concealed or misrepresented to.

Both come with hefty fines as well as the potential for a long imprisonment in a federal penitentiary for those who are convicted. Tax Avoidance vs Tax Evasion. Tax Avoidance And Tax Evasion 3 5.

Where tax avoidance is not necessarily illegal tax evasion always is. Also neither is considered tax avoidance which is the legal means of minimizing taxes through legitimate. BT MA FA LW PM TX FR AA FM SBL SBR SBR AFM APM ATX AAA AAA.

Tax planning either reduces it or does not increase your tax risk. Because there is a difference between tax evasion and tax evasion. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk.

Tax avoidance means legally reducing your taxable income. Tax evasion and avoidance schemes are designed to reduce peoples tax bills and are both viewed negatively by HMRC. The difference between tax avoidance and tax evasion essentially comes down to legality.

Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt.

Your Thoughts Tax Avoidance Offshore Loopholes

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

The Economics Of Tax Avoidance And Evasion The International Library Of Critical Writings In Economics Series 334 Dharmapala Dhammika 9781785367441 Amazon Com Books

The Concept Of Tax Evasion And Tax Avoidance Definition And Differences

Taxpayer Income Tax Concept Stick Figure Pictogram Icon Cliparts Photo Pictogram Tax Finance

Tax Avoidance Vs Tax Evasion What S The Difference

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Tax Evasion Tax Avoidance Definitions Differences Nerdwallet

Tax Avoidance Vs Tax Evasion Infographic Fincor

22 Taxing Quotes On The Good Bad And Evil Of Federal Income Tax

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Differences Between Tax Evasion Tax Avoidance And Tax Planning